-

Author

Opemipo Akerele -

PI

Ope Akerele

-

Co-Author

Thais Salles Araujo, MD; Kimberly Narain, MD, MPH, PhD

-

Title

The Impact of State Earned Income Tax Credits on Dietary Quality Among Single Mothers

-

Program

CTSI TL1 Summer Program

-

Other Program (if not listed above)

Leichtman-Levine-TEM Summer Mentorship in Women's Health Research at the Iris Cantor-UCLA Women's Health Center

-

Abstract

Introduction: Food insecurity is defined as “the limited or uncertain availability of nutritionally adequate and safe foods or limited or uncertain ability to acquire acceptable foods in socially acceptable ways.” A growing concern in the COVID-19 Pandemic, food insecurity has a well-established association with poor nutrition and nutrition-related chronic disease such as obesity, diabetes, hyperlipidemia, and hypertension. Food insecurity is also positively associated with poverty. A growing body of studies have found that the federal Earned Income Tax Credit (F-EITC), a refundable tax credit for low-income workers and the largest antipoverty cash assistance program in the US, has reduced the prevalence of food insecurity amongst vulnerable populations, e.g. single mothers and children. However, little is known about how state-level EITC policies (S-EITC) have impacted the diets of at-risk populations. Even less is known about differential effects of SEITC policies on dietary quality across racial/ethnic groups, which may vary as a consequence of differences in knowledge, culture, and environment. This study will evaluate the impact of S-EITC generosity on the dietary quality of single mothers with low levels of education, across racial/ethnic group.

Research Objective: To evaluate the impact of S-EITC policy generosity on dietary quality among single mothers with low education, across racial/ethnic group.

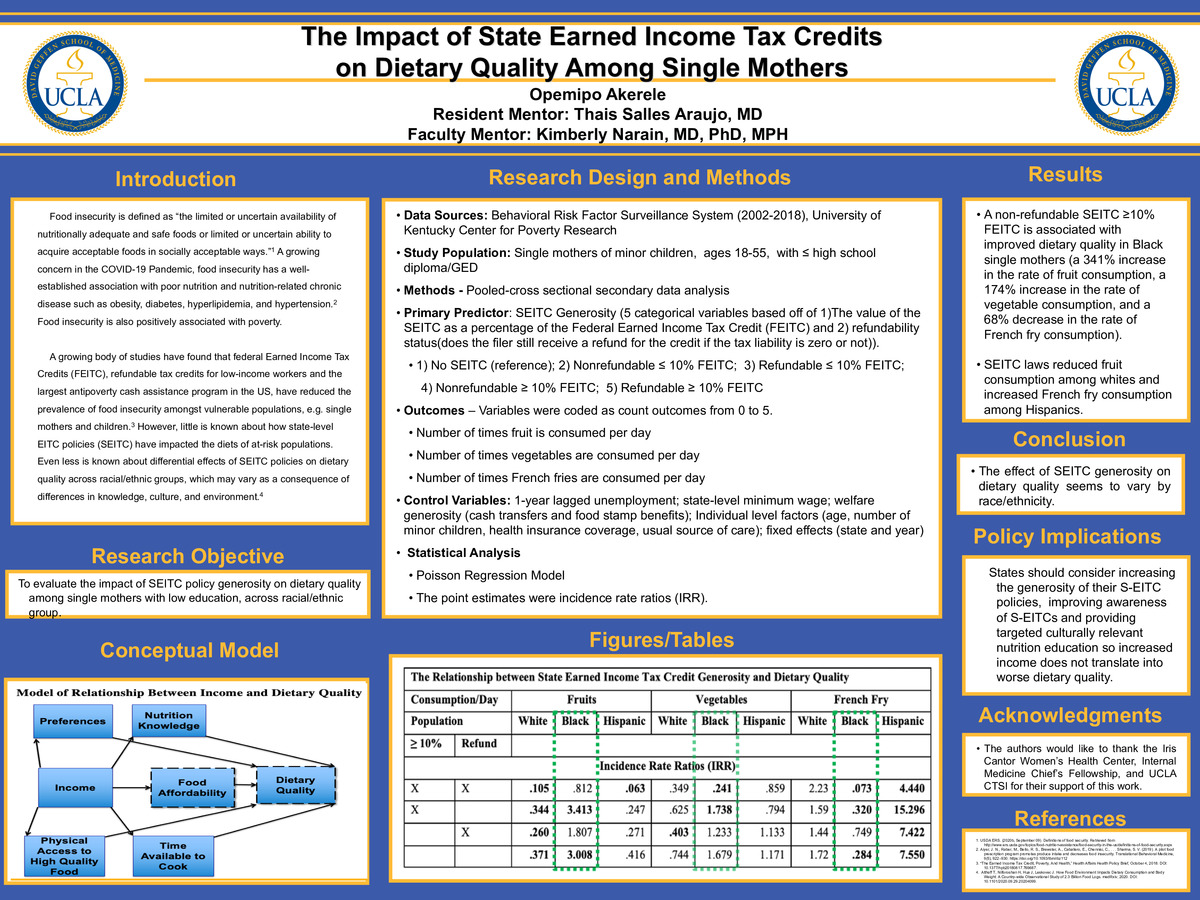

Study Design: This study leveraged existing 2002-2018 data collected from the Behavioral Risk Factor Surveillance System (BRFSS) merged with University of Kentucky Center for Poverty Research National Welfare data to conduct a pooled-cross sectional analysis. The study population included single mothers of minor children with a high school diploma (or General Education Development Test) or less, between the ages of 18-55. The primary predictors are a group of categorical variables reflecting S-EITC generosity that are created based on the value of the credit as a percentage of the Federal Earned Income Tax Credit (F-EITC) and refundability status (the credit is still received even when the tax liability is “0”). The five categorical variables are 1. no S-EITC (reference group), 2. nonrefundable ≤ 10% F-EITC, 3. refundable ≤ 10% F-ETIC, 4. nonrefundable ≥ 10% F-EITC, and 5. refundable ≥ 10% F-EITC). The study outcomes are count variables developed based off of self-reported fruit, vegetable, and French fry consumption in the last 30 days. Race/ethnicity-stratified (Non-Hispanic White, Non-Hispanic Black, Hispanic) Poisson Regressions Models were used to model the relationship between S-EITC generosity and dietary quality, across racial/ethnic groups. The point estimates were incidence rate ratios (IRR). All models controlled for 1-year lagged unemployment, minimum wage, welfare generosity (cash transfers and food stamp benefits), individual-level demographics (age, number of minor children, health insurance coverage, usual source of care), and included fixed effects for state and year. Standard errors robust and clustered at the state-level. All monetary values adjusted for inflation. All models weighted to account for complex survey design and nonresponse by using BRFSS sampling weights. STATA Version 13 (StataCorp LP, College Station, TX) was used for all analyses.

Results: S-EITC generosity improved dietary quality in the sample of Black single mothers while generosity was associated with worse dietary quality in White and Hispanic single mothers. White single mothers residing in states with generous S-EITC (nonrefundable ≥ 10% F-EITC) had a 66% decrease (IRR=.344, p-value=0.008) in the rate of fruit consumption, relative to White single mothers residing in states with no S-EITC law. Black single mothers residing in states with generous S-EITC (nonrefundable ≥ 10% F-EITC) had a 341% increase (IRR=3.413, p-value=0.000) in the rate of fruit consumption, a 174% increase in the rate of vegetable consumption (IRR=1.738, p-value=0.000) and 68% decrease in the rate of French fry consumption (IRR=.320, p-value=0.000), relative to Black single mothers residing in states with no S-EITC. Hispanic single mothers residing in states with generous refundable S-EITC laws (refundable ≥ 10% F-EITC) had a 94% decrease (IRR=.063, p-value=0.018) in the rate of fruit consumption and 444% increase in the rate of French fry consumption (IRR=4.440, p-value=0.003), relative to Hispanic single mothers residing in states with no S-EITC law.

Conclusions: High generosity of S-EITC laws is associated with improved dietary quality in Black single mothers and worsened dietary quality among White and Hispanic single mothers of minor children with low education.

Implications for Policy or Practice: To address food security and improve dietary quality among black single mothers, stakeholders should consider increasing the generosity of S-EITC policies as well as, improving awareness and accessibility of S-EITCs for this subgroup. At the same time, states should also provide targeted culturally relevant educational content regarding dietary quality to ensure that additional financial resources do not translate into poorer dietary choices for some racial groups.

-

PDF

-

Zoom

https://uclahs.zoom.us/j/93842618561?pwd=QllQNFlXYnZpUVU2YUw2dHJjQ3ZPZz09